আরও দেখুন

26.12.2025 12:54 AM

26.12.2025 12:54 AMOn the eve of Christmas, the Japanese yen strengthened against the weakening U.S. dollar, hitting a new weekly high.

Minutes from the Bank of Japan's October meeting revealed that council members actively discussed the possibility of further interest rate hikes. Additionally, rising geopolitical tensions between the U.S. and Venezuela, the conflict between Russia and Ukraine, and the risk of renewed conflict between Israel and Iran are contributing to the Japanese yen's strength, as it is considered a safe haven.

The BoJ's position, as it leans towards tightening monetary policy, significantly diverges from the Federal Reserve's expectations of further easing. This has led to a decrease in the dollar's exchange rate to levels observed in early October. At the same time, positive market sentiment is a hurdle for the Japanese yen, helping the USD/JPY pair find support just above the psychological level of 155.00. Nevertheless, fundamental factors favor the bulls for the Japanese yen.

The overall backdrop creates expectations of BOJ interest rate hikes and a flight of investors to safe-haven assets. For instance, the minutes from the BOJ's October meeting indicate that council members agree on the possibility of continuing with rate hikes if macroeconomic forecasts are realized. In December, the central bank raised the rate to 0.75%, reaching a 30-year high, while leaving the door open to further tightening.

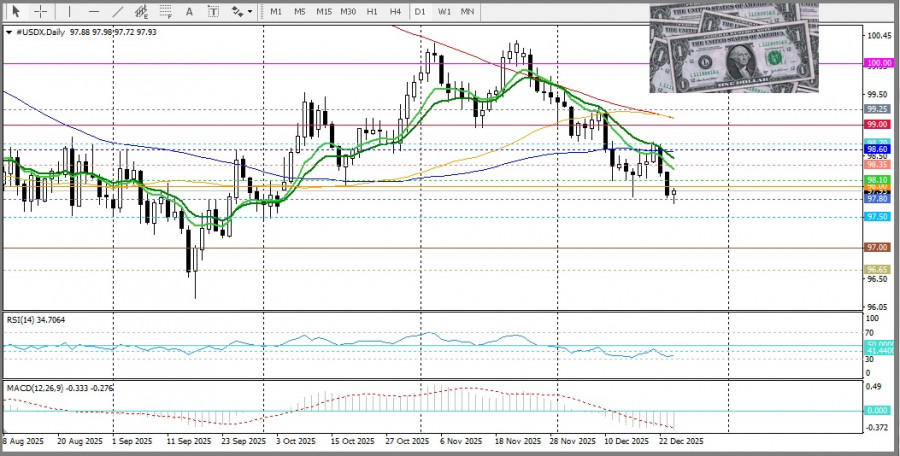

The U.S. dollar index (DXY), which tracks the dollar's performance against a basket of currencies, fell to levels not seen since October amid expectations of two more rate cuts by the Fed in 2026.

According to a statement from U.S. President Donald Trump, any nominee for the Fed chair must guarantee lower rates even with favorable economic indicators. This overshadows the optimistic U.S. GDP growth data published on Tuesday, which indicated a 4.3% year-over-year growth for the July to September period, surpassing expectations. However, this does little to bolster dollar bulls or mitigate the prevailing selling trend.

This week, attention should be focused on the upcoming consumer price index data for Tokyo, scheduled for Friday, which could significantly impact the short-term dynamics of the Japanese currency.

From a technical perspective, oscillators on the daily chart are positive, indicating that bulls in the USD/JPY pair are not ready to give up. However, if prices cannot maintain the current level, it could accelerate the decline toward the round number of 155.00. Yet if prices can return above the round levels of 156.00 and 156.50, the chances of a return to the round number of 157.00 will increase.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।