यह भी देखें

02.01.2026 06:10 PM

02.01.2026 06:10 PMToday, Friday, the EUR/USD pair continues to decline from its December high. The weakening of the currency pair is driven by negative data on eurozone manufacturing activity, which has strengthened bearish sentiment toward the euro amid relatively quiet New Year trading conditions. Nevertheless, the EUR/USD rate remains close to the three-month high of 1.1808, reached just before the holidays.

Over the past year, the U.S. dollar has fallen by approximately 14% against the euro amid market concerns about the inconsistency of U.S. policy under Donald Trump, as well as signs of a slowdown in the U.S. economy and differences in monetary policy between the ECB and the Federal Reserve.

The latest final PMI data for Germany and the eurozone — the manufacturing Purchasing Managers' Index — point to a deterioration in the contribution of manufacturing activity to the region's gross domestic product. Today, attention should also be paid to the release of the final U.S. PMI data (S&P), which may bring fresh movement to the dollar's dynamics.

From a technical perspective, the pair has found support at the 20-day SMA, while oscillators on the daily chart remain in positive territory, confirming the bulls' ability to hold their ground. If prices fall below the 20-day SMA, the next support will be found at the round level of 1.1700. Below this level, the bias would shift in favor of the bears. Conversely, if prices manage to break above the 9-day EMA, followed by the 1.1760 level, a successful move through it would accelerate the advance toward the round level of 1.1800.

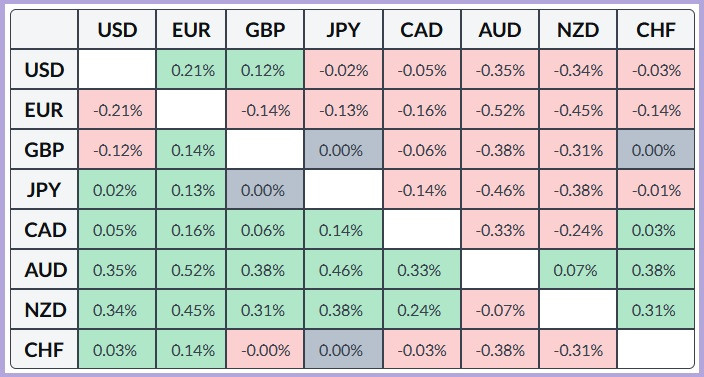

The table below shows the percentage change of the euro against major currencies today. The most notable strengthening of the euro was recorded against the Japanese yen.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |