Lihat juga

15.04.2024 03:04 PM

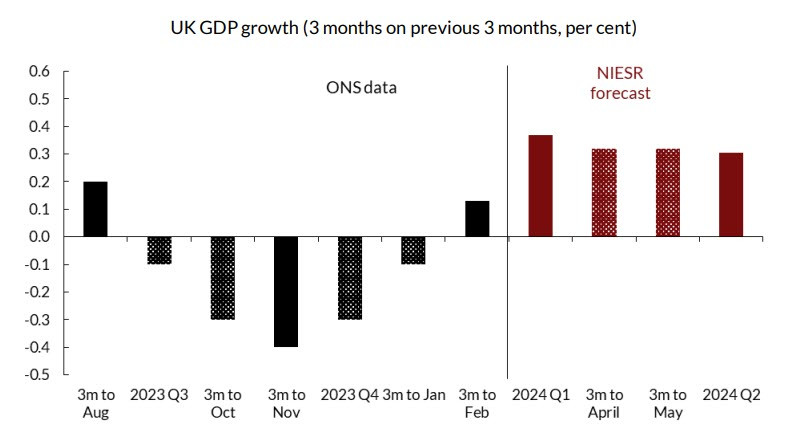

15.04.2024 03:04 PMThe UK economy is recovering from a mild recession in 2023. According to NIESR, UK GDP grew by 0.1% in February, driven by increased production volumes, particularly in the manufacturing and services sectors.

NIESR forecasts GDP to grow by 0.4% in the first quarter and by 0.3% in the second quarter of 2024.

As for inflation, the main indicator that will help predict the future policy of the Bank of England, Wednesday's data will clear things up. It is expected that UK inflation will ease further, but core inflation will remain above 4% year-over-year. Last Friday, markets were pricing in the first Bank of England rate cut in June. However, the US inflation report, which shifted expectations of a Fed rate cut to September, has scrambled the predictions. There is a high probability that the Bank of England will begin its rate-cutting cycle before the Fed.

In addition to the inflation report, attention should be paid to jobs data to be released on Tuesday. A key point here could be the first decrease in average earnings growth excluding bonuses below 6% year-over-year since last September. If data meets forecasts, and inflation figures are not worse than expected, the GBP/USD pair will have a chance to rise as part of a bullish correction. However, if there are signs of more persistent inflation, a short-term spike in volatility will likely drag the British pound down amid fading expectations that the Bank of England will cut rates before the Federal Reserve.

Historically, the Bank of England has always started its rate adjustments slightly behind the Fed, making August and especially June in current forecasts seem more like fantasy than reality.

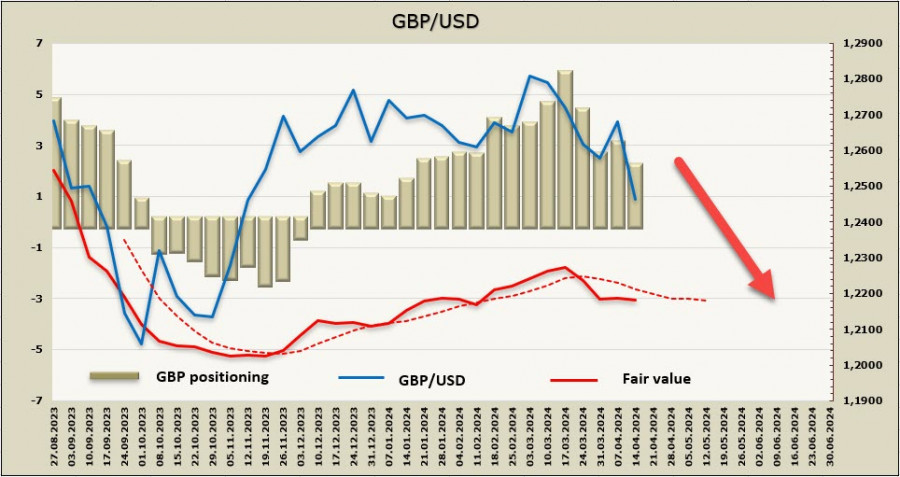

The net short position on the pound sterling decreased by 1.2 billion over the reporting week to 2.2 billion. Positioning is still bullish, but the trend towards exiting long positions is increasingly apparent. The price is below the long-term moving average and is heading down.

As expected, the pound has fallen below the support level of 1.2500. Its further dynamics will depend on how the situation with global risk aversion unfolds. There is no basis to expect a bullish reversal. A possible bullish run is likely to be limited by the resistance level of 1.2500. Technically, the level of 1.2354 can be seen as a target.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.