Veja também

16.04.2025 01:08 AM

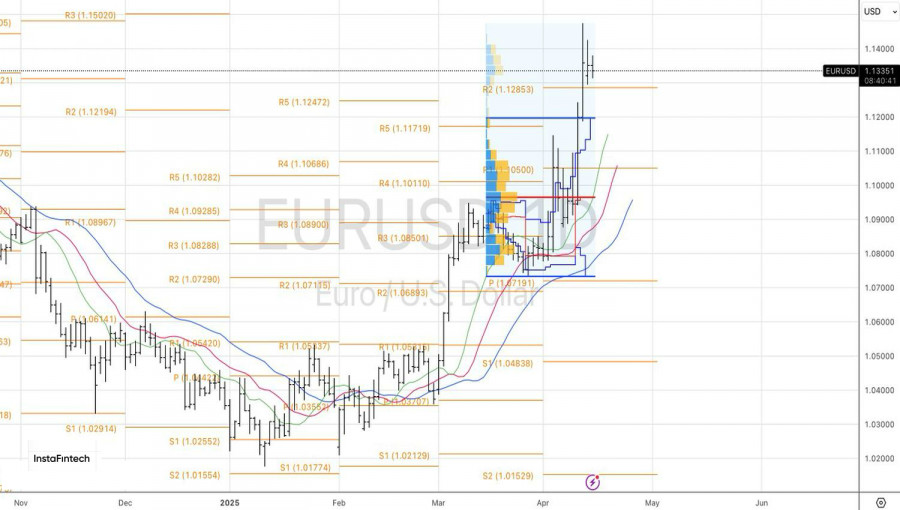

16.04.2025 01:08 AMThe euro's surge to the area of three-year highs became possible thanks to Germany's fiscal stimulus, Donald Trump's trade policy, and a capital outflow from North America into Europe. When investors stopped buying stock indices in the EU, they turned their attention to German bonds. These became the alternative to Treasuries and helped push EUR/USD higher.

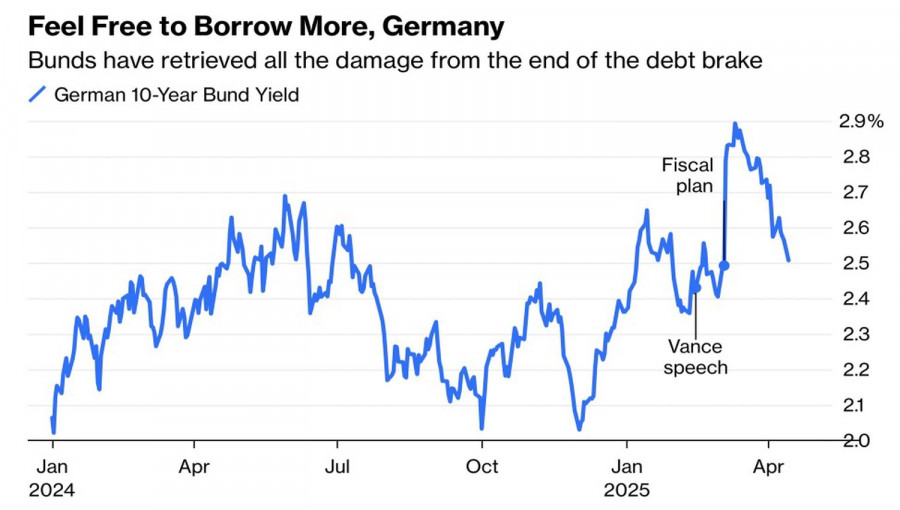

Some are mesmerized by the rollercoaster in the S&P 500, others by the sell-off in U.S. Treasury bonds, and some can't take their eyes off Germany's debt instruments. German bond yields have returned to the levels from which their rally began—after the Bundestag amended the fiscal brake rule. The peak was reached in mid-March, after which investors fled to safe havens, reversing the upward trend in yields.

In theory, a widening yield spread in favor of U.S. Treasuries should lead to a drop in EUR/USD due to the increased attractiveness of U.S. assets. In practice, the surge in U.S. bond yields is the result of foreign investor sell-offs—former allies of Washington turning into rivals.

Treasury Secretary Scott Bessent calmed the markets with a statement that the Treasury has an arsenal of tools capable of knocking the wind out of any opponent. The stabilization of yields and their spread relative to German bonds resembled the calm before the storm, keeping EUR/USD stuck in a narrow trading range.

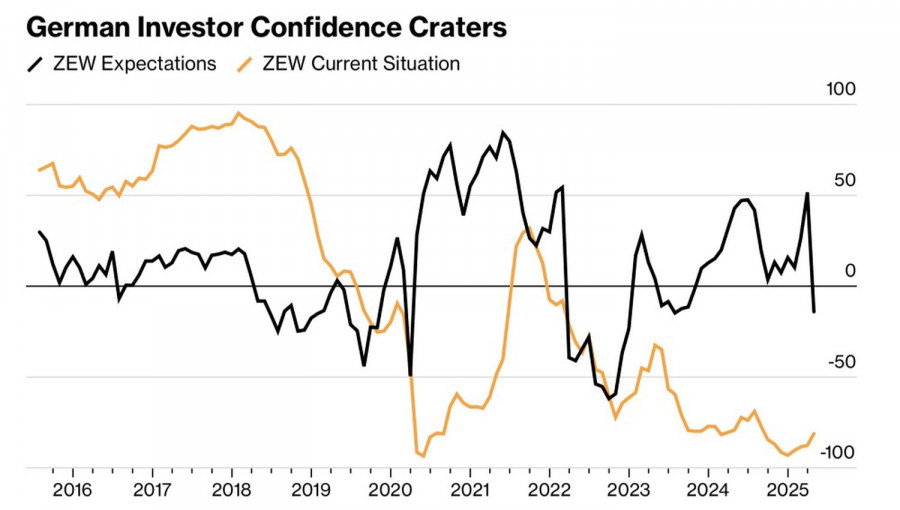

The main currency pair is waiting for signals from the U.S. stock market and ignoring the sharp drop in investor confidence in the German economy. The ZEW expectations index collapsed from 51.6 to -14 in April due to concerns over the White House's tariff impact on the German economy.

It's worth noting that the capital flow from North America to Europe is not the only driver of the EUR/USD rally. According to forecasts from The Wall Street Journal, U.S. GDP is expected to grow by a modest 0.8% in 2025—about the same as in Europe. That's quite unusual, considering tariffs' damaging effects on the export-driven eurozone. Analysts likely considered the sharp rise in German exports in 2024, which hit the highest level since 2002.

However, this was driven by front-loaded U.S. imports ahead of Donald Trump's inauguration. Going forward, Germany's economy is unlikely to perform as well as it did at the 2024–2025 turn. This factor could hinder further euro appreciation, especially ahead of the European Central Bank's expected rate cuts.

From a technical perspective, a so-called inside bar has formed on the daily EUR/USD chart, signaling market indecision. A breakout below the lower boundary around 1.129 would justify short-term selling, while a successful push above the upper boundary near 1.143 would open the door for buying.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.