See also

01.04.2025 10:42 AM

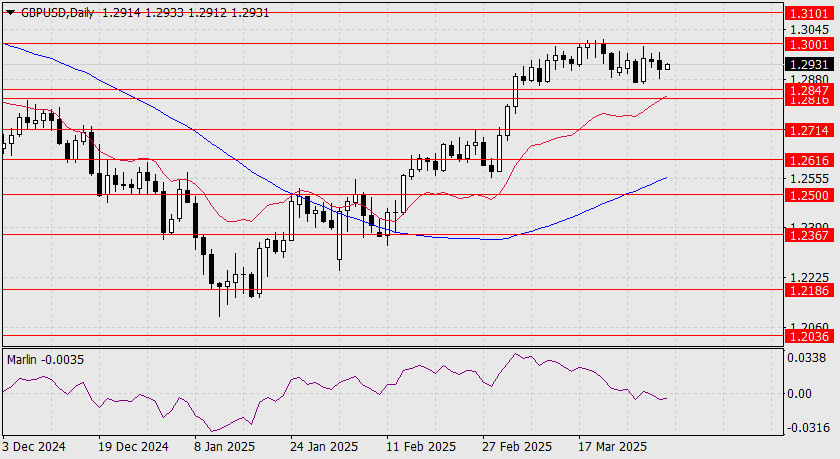

01.04.2025 10:42 AMGBP/USD Only one day remains before President Trump imposes expanded tariffs on all "unfair" U.S. trade partners. The British pound remains uncertain about the UK's position on Washington's partnership list. The sideways trend within the 1.2847–1.3001 range continues. The current trend is clearly upward, and its technical outlook supports further growth.

We believe that Trump's tariffs against the United Kingdom will be relatively modest ("symbolic"), as since December last year, the stance of official U.S. media toward the UK has been neutral, and it's unlikely that the White House administration will dramatically alter that assessment in a moment of political fervor. A technical signal for continued growth would be a breakout above the upper boundary of the range at 1.3001. The next target would open at 1.3101, followed by 1.3184 – a strong level that has been relevant since 2019. The Marlin oscillator is currently pulling the price downward, but given the broader context, this could be interpreted as a factor restraining premature price growth.

On the four-hour chart, the price did make a dip below the balance line, but then quickly returned above it, consistent with the ongoing sideways trend. A more convincing signal of further growth would be the price securing itself above the MACD line (1.2947).

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.