See also

18.12.2025 12:28 AM

18.12.2025 12:28 AMTroubles seldom come alone. Joy seems to come in packs as well. The Federal Reserve's rate cuts, geopolitical tensions, and the slowdown in global economic growth have intertwined to help gold shine once more. When the precious metal fell from its record highs in October, rumors spread that a return would take years. However, in reality, XAU/USD could set a new historical peak even before the end of 2025.

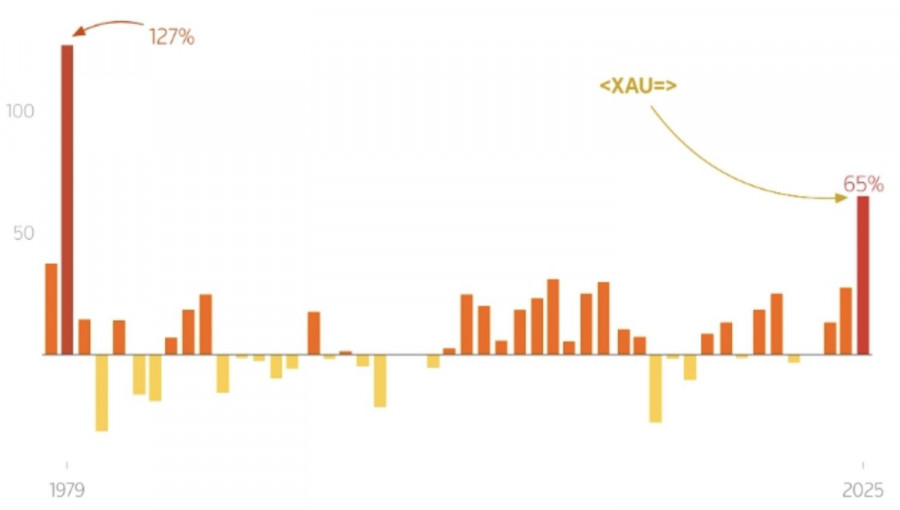

Gold is heading toward its best annual result since 1979. Back then, its prices surged by 127% as the White House pressured the Fed to lower rates. A similar picture is emerging now. Donald Trump is demanding that the central bank lower borrowing costs to 1% or lower. To achieve this, the White House intends to change the composition of the FOMC, starting from the top—with a new chairman.

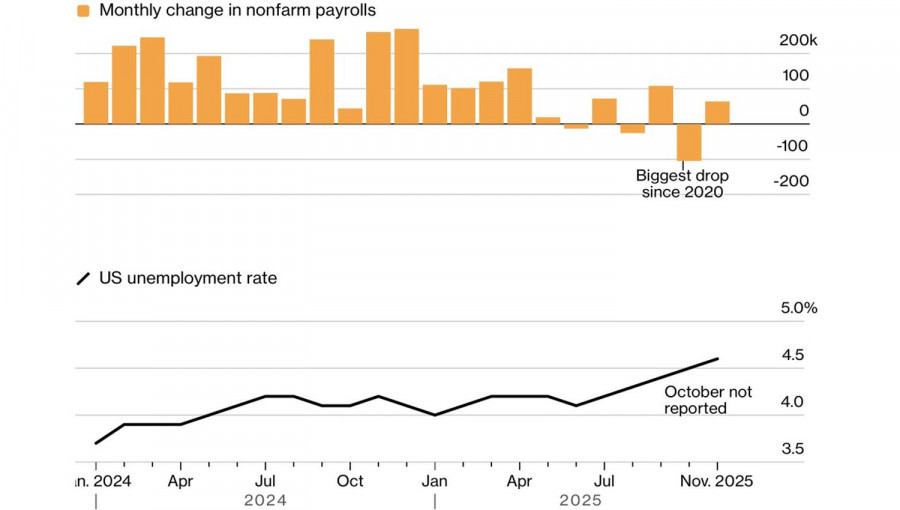

So far, the reports from the U.S. labor market have left a mixed impression. The rise in unemployment to a four-year high, combined with a decrease of over 100,000 in non-farm employment in October, contrasts with strong figures for November. The futures market does not see a continuation of the Fed's monetary expansion cycle in January, and the chances of it happening in March are seen as fifty-fifty.

Nevertheless, the reluctance of retail sales to grow, along with disappointing business activity data, indicates that not everything is well with the U.S. economy. Its slowdown is a strong argument for further cuts in the federal funds rate, which would favor XAU/USD.

Gold is also supported by geopolitics. Donald Trump's order to block sanctioned tankers heading to and from Venezuela increases investor demand for safe-haven assets.

Goldman Sachs maintains its forecast for the precious metal's price to reach $4,900 per ounce by 2026, citing central banks' insatiable appetite for gold bars. The firm continues to project its average monthly purchases at 70 tons, significantly above historical averages. According to BNP Paribas, gold is expected to rise to $5,000. This will be supported by a correction in the U.S. stock market, a slowdown in global GDP, and heightened inflationary pressures.

In my view, a prolonged pause in the Fed's monetary easing cycle will strengthen the dollar and raise yields on U.S. Treasury bonds. This environment is unfavorable for the precious metal, and its rally potential is limited. Moreover, the conclusion of the armed conflict in Ukraine will slow down active bar purchases by central banks as part of their reserve diversification process.

Technically, on the daily chart, gold is experiencing its fourth test of resistance at the pivot level of $4,333 per ounce. The success of the bulls in this endeavor will allow for the increase of long positions formed from $4,265. Conversely, failure will serve as a reason to sell the precious metal.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.