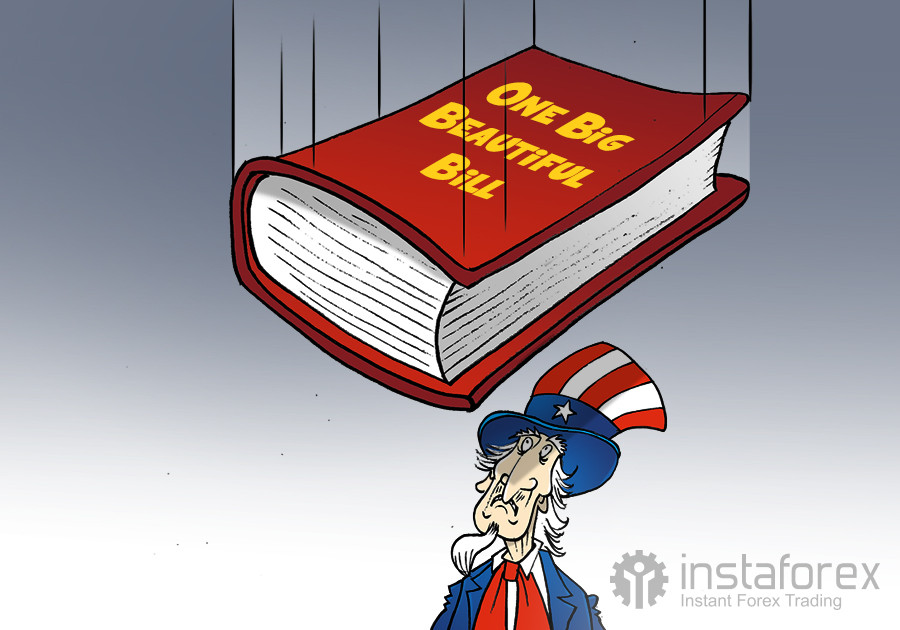

UBS questions consumer gains from Trump's 'Big Beautiful Bill'

UBS analysts are casting a critical eye on President Donald Trump's so-called "Big Beautiful Bill," questioning its potential benefits for American consumers. Unfortunately, the outlook leaves little room for optimism. According to the firm's latest assessment, the Republican tax legislation from the US House of Representatives "adds yet another element of uncertainty into the investment landscape for consumer stocks."

The bill includes broad personal tax provisions that are expected to boost consumers' overall purchasing power over the coming years. However, UBS estimates that these gains will be "partially offset by lower federal assistance contribution (e.g. SNAP, Medicaid, etc), as well as student loan reforms."

According to UBS projections, the legislation could drive a 3% increase in personal consumption expenditures (PCE) between 2025 and 2028. This estimate is roughly in line with the bank's base forecast of 2.8% for this year but lags behind the 4.3% growth recorded in the first quarter of 2025.

Using the Penn Wharton Budget Model and data from the Bipartisan Policy Center, UBS finds that an increase in consumer spending "should see a tailwind from new and expanded individual tax provisions." However, this will be offset by projected cuts to federal aid and student loans totaling $520 billion from 2025 to 2028. Analysts note that much of the outcome will hinge on income levels.

Lower-income consumers may face a "net headwind," while "middle-income consumers… should benefit" from expanded credits and deductions. "Higher income consumers would likely benefit" from estate tax and pass-through income provisions, UBS stated.

"Households in the bottom quintile income group would see a -5.7% median reduction in after-tax and after-transfer income," while "the top income quintile… could see a median 2.1% increase," the firm estimates.

Based on these findings, UBS concludes, "the benefits to high-earners might outweigh the headwinds of lower-income consumers in terms of aggregate spending impact." After all, "the top 10% of households are driving nearly ~50% of total personal spending."